Quarterly Banking Profile - Fourth Quarter and Full-Year 2019

Good morning, and welcome to our release of full-year and fourth quarter 2019 performance results for FDIC-insured institutions.

The banking industry remains strong, despite declines in full-year and quarterly net income. Positive loan growth, stable asset quality indicators, and a decline in the number of "problem banks" continued during the fourth quarter.

Community banks also reported another positive quarter, as higher net operating revenue boosted quarterly net income. Additionally, the annual loan growth rate at community banks outpaced the overall industry's growth rate.

The record-long economic expansion continued in the fourth quarter. However, with three reductions in short-term rates during the second half of 2019, challenges in lending and funding persisted. The environment to attract and expand loan customers and depositors remains competitive and challenging. Consequently, banks need to maintain rigorous underwriting standards and prudent risk management.

Awareness of interest-rate, liquidity, and credit risks will position banks to be more resilient in maintaining lending.

I am joined here today by Diane Ellis, Director of the Division of Insurance and Research; Pat Mitchell, Deputy Director of the Division of Insurance and Research; and Doreen Eberley, Director of the Division of Risk Management Supervision, to discuss bank performance during the full-year and fourth quarter 2019.

Diane, I will now turn this over to you. Thank you.

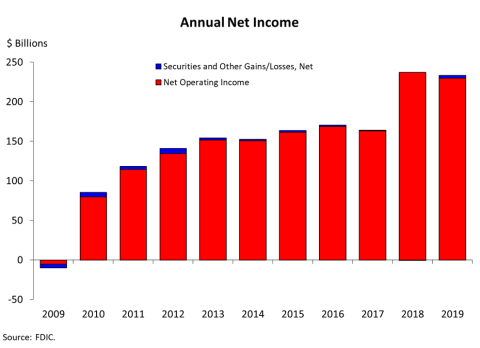

Chart 1:

Thank you, Chairman McWilliams.

Our first chart shows that full-year 2019 net income fell to 233.1 billion dollars, down 1.5 percent from 2018. The decline was primarily attributable to slower growth in net interest income, an increase in loan-loss provisions, and lower noninterest income. The average return-on-assets ratio declined from 1.35 percent in 2018 to 1.29 percent in 2019.

Community banks reported annual net income of 25.8 billion dollars in 2019, up 7.5 percent from 2018.

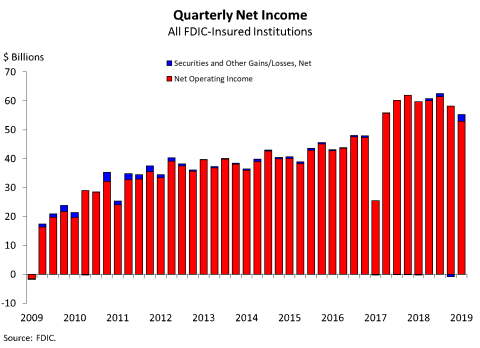

Chart 2:

Chart 2 shows that the banking industry reported quarterly net income of 55.2 billion dollars during the fourth quarter, a 6.9 percent decline from a year ago. About half of all banks reported annual declines in net income and 7.2 percent of institutions were unprofitable. The industry’s return-on-assets ratio was 1.20 percent in the fourth quarter, down from 1.33 percent a year ago. The decline is attributable to reductions in net interest income and increases in noninterest expense.

Community banks reported quarterly net income of 6.4 billion dollars in the fourth quarter. Unlike the industry as a whole, this was an increase of 4.4 percent from a year ago.

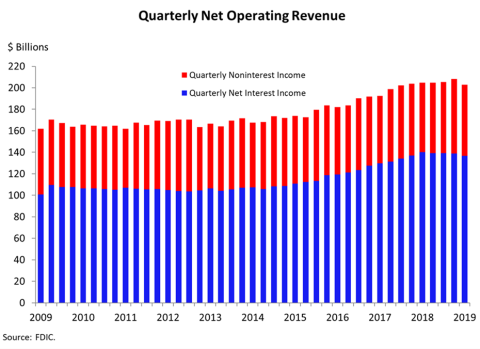

Chart 3:

The next chart shows that net operating revenue totaled 202.8 billion dollars in the fourth quarter, down less than 1 percent from a year ago. The decline in revenue was due to lower net interest income, which fell by 2.4 percent. This was the first annual decline since third quarter 2013, and the result of lower yields on earning assets.

Noninterest income improved by 2.5 percent from a year ago, led by higher trading revenue and an increase in net gains on loan sales.

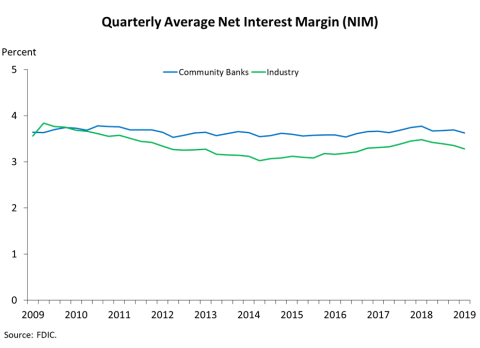

Chart 4:

Chart 4 shows that the average net interest margin for the industry was 3.28 percent in the fourth quarter, down from a recent high of 3.48 percent at year-end 2018. The decline was broad-based, as net interest margins declined for all five asset size groups featured in the Quarterly Banking Profile. The decline was caused by yields on earning assets falling more than funding costs.

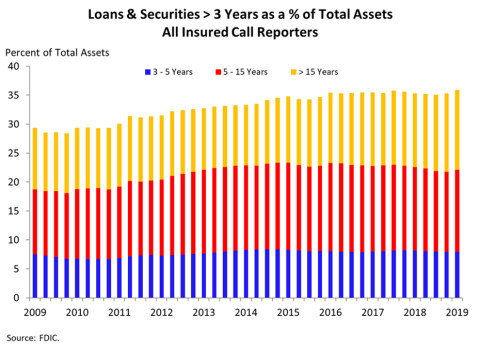

Chart 5:

Chart 5 shows that the share of longer-term assets relative to total industry assets reached a new high in fourth quarter 2019, with more than one-third of industry assets maturing or repricing in three or more years.

The interest-rate environment continues to challenge banks. During the post-crisis period of low interest rates, some banks responded by "reaching for yield" by investing in longer-term assets or reducing liquid assets to increase their yield on earning assets and maintain net interest margins. In the current low interest-rate environment, banks, once again, are growing long-term assets. However, these assets are being originated at lower yields, which contributed to the decline in net interest margins.

Community banks are particularly vulnerable to fluctuating interest rates, as nearly half of their assets mature or reprice in three or more years.

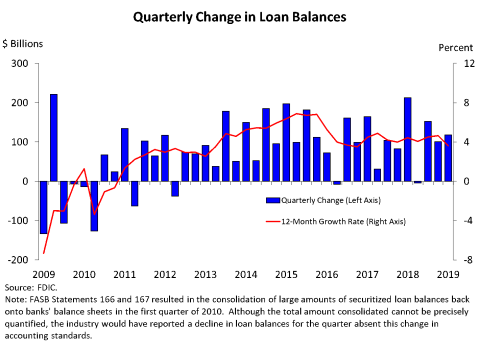

Chart 6:

Chart 6 shows that loan balances rose by 117.9 billion dollars during the fourth quarter and 3.6 percent during the last year. Almost all of the major loan categories reported quarterly increases, except for the commercial and industrial loan portfolio, which reported the first quarterly decline since fourth quarter 2016. On an annual basis, the commercial and industrial loan portfolio grew at its lowest rate since 2010.

Loan growth at community banks was strong, with total loans rising by 5.5 percent from a year ago. The commercial real estate loan portfolio drove growth among community banks, with increases in loans for both existing properties and for construction and development.

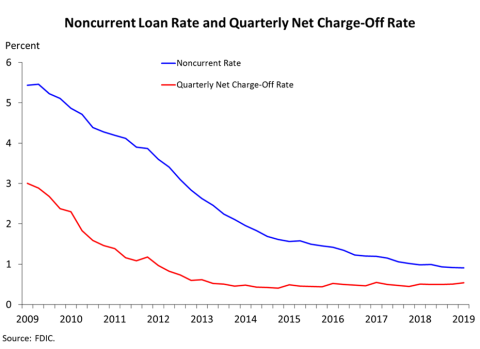

Chart 7:

The next chart shows that asset-quality indicators remain generally stable. The noncurrent loan rate declined by 1 basis point from the previous quarter to 0.91 percent, while the net charge-off rate rose by 4 basis points from a year ago to 0.54 percent.

The commercial and industrial loan portfolio reported the largest dollar increase in net charge-offs for the current quarter. The net charge-off rate for commercial and industrial loans increased to 0.42 percent from 0.32 percent a year ago, but remains below the recent high of 0.50 percent reported in fourth quarter 2016.

Modest deterioration in agriculture loan portfolios continued, as challenges for the agriculture sector remain. The net charge-off rate for agriculture loans remained low, but noncurrent rates increased in both farmland and agricultural production loan categories. Community banks' agriculture loan noncurrent rate increased 5 basis points from the previous quarter to 1.32 percent, and the agriculture loan net charge-off rate increased 1 basis point to 0.18 percent.

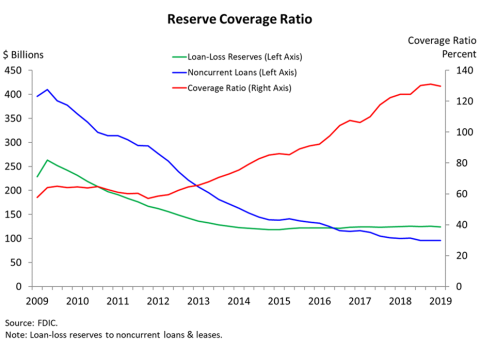

Chart 8:

Chart 8 shows that the industry’s reserve coverage ratio, which measures loan-loss reserves relative to total noncurrent loan balances, declined slightly from the previous quarter to 129.7 percent. The quarterly reduction in the reserve coverage ratio was due to a slight decrease in loan-loss reserves.

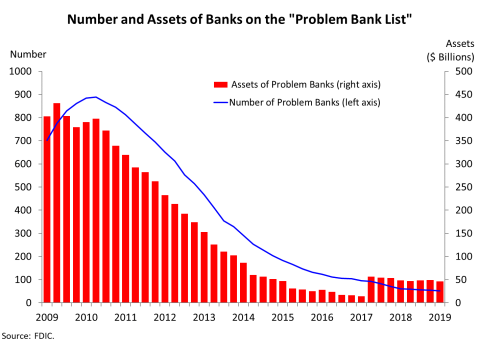

Chart 9:

Chart 9 shows that the number of banks on the FDIC’s “Problem Bank List” declined from 55 to 51 during the quarter. This is the lowest number of problem banks since fourth quarter 2006. Three new banks opened in the fourth quarter, for a total of 13 new banks in 2019. Three banks failed during the quarter.

Chart 10:

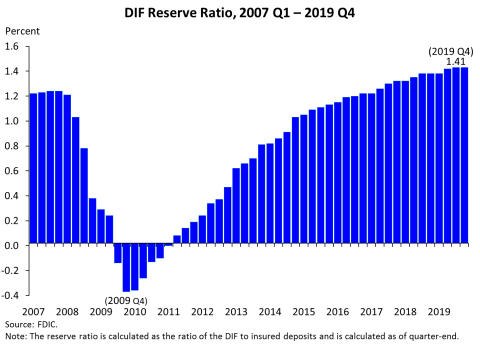

The Deposit Insurance Fund (DIF) balance was 110.3 billion dollars on December 31, up 1.4 billion dollars from the end of last quarter. Assessment income was the largest contributor to the increase in the fund, followed by interest earned on investment securities held by the DIF. Estimated insured deposits were 7.8 trillion dollars at the end of December, an increase of 1 percent from last quarter.

Chart 10 shows that the reserve ratio—the amount in the Deposit Insurance Fund relative to insured deposits—remained at 1.41 percent at the end of December.

Small banks earned a total of 765 million dollars in credits for the portion of their assessments that contributed to growth in the reserve ratio from 1.15 percent to 1.35 percent. The FDIC will apply approximately 145 million dollars of credits to offset the fourth quarter assessments of small banks, which are due in March. By March 31, the FDIC estimates that it will have applied a total of 704 million dollars, or 92 percent, of the credits earned by small banks.

In summary, the banking industry reported a decline in both full-year and quarterly net income and is facing some headwinds caused by the interest-rate environment. However, the banking industry fundamentals remain strong, with continued loan growth, stable asset quality indicators, and a decline in the number of "problem banks."

We will now answer questions regarding full-year or fourth-quarter performance of the banking industry.

Thank you.