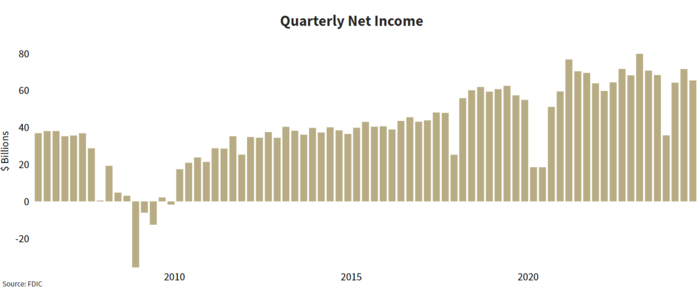

FDIC-Insured Institutions Reported Net Income of $65.4 Billion in the Third Quarter

For Release

- Net Income Decreased From the Prior Quarter, Driven By One-Time Items

- Community Bank Net Income Increased Quarter Over Quarter

- Net Interest Income Increased as the Net Interest Margin Rose Across All Size Groups in the Quarterly Banking Profile

- Asset Quality Metrics Remained Generally Favorable, Though Weakness in Certain Portfolios Persists

- Loan Balances Increased Modestly From the Prior Quarter and a Year Earlier

- Domestic Deposits Increased From the Prior Quarter, Driven by Higher Uninsured Deposits

- The Deposit Insurance Fund Reserve Ratio Increased Four Basis Points to 1.25 Percent

“The banking industry continued to show resilience in the third quarter. Net interest income and the net interest margin increased substantially this quarter. Asset quality metrics remained generally favorable despite continued weakness in several loan portfolios, which we are monitoring closely. The banking industry still faces significant downside risks from the continued effects of inflation, volatility in market interest rates, and geopolitical uncertainty.”

— FDIC Chairman Martin J. Gruenberg

_______________________________

WASHINGTON— Reports from 4,517 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $65.4 billion in third quarter 2024, a decrease of $6.2 billion (8.6 percent) from the prior quarter. The absence of one-time gains on equity security transactions that occurred last quarter drove the quarterly decrease. These and other financial results for third quarter 2024 are included in the FDIC’s latest Quarterly Banking Profile released today.

Highlights from the Third Quarter 2024 Quarterly Banking Profile

The Industry’s Net Income Decreased From the Prior Quarter, Driven By One-Time Items: Third quarter net income for the 4,517 FDIC-insured commercial banks and savings institutions decreased $6.2 billion (8.6 percent) from the prior quarter to $65.4 billion. The quarterly decrease in net income was largely driven by the absence of about $10 billion in one-time gains on equity security transactions reported in the previous quarter. The absence of these nonrecurring gains was partially offset by strong net interest income in the third quarter.

The banking industry reported an aggregate return-on-assets ratio (ROA) of 1.09 percent in third quarter 2024, down 11 basis points from one quarter earlier and down 8 basis points from one year earlier.

Community Bank Net Income Increased Quarter Over Quarter: Quarterly net income for the 4,082 community banks insured by the FDIC was $6.9 billion in the third quarter, an increase of $436 million (6.7 percent) from second quarter 2024. Higher net interest income (up $574 million, or 2.7 percent) and higher noninterest income (up $48 million, or 0.9 percent) more than offset higher noninterest expense (up $142 million, or 0.8 percent) and higher provision expense (up $128 million, or 13.9 percent). The community bank pretax ROA increased 8 basis points from last quarter to 1.21 percent.

Net Interest Income Increased as the Net Interest Margin Rose Across All Size Groups in the Quarterly Banking Profile: The industry reported a quarter-over-quarter increase in net interest income of $4.5 billion as the net interest margin (NIM) increased seven basis points to 3.23 percent. All bank size cohorts in the Quarterly Banking Profile reported a higher NIM in the third quarter. Despite the positive quarter, the industry’s third-quarter NIM was two basis points below the pre-pandemic average NIM.1 The community bank NIM of 3.35 percent increased five basis points quarter over quarter, increasing for the second consecutive quarter, but is still below the pre-pandemic average of 3.63 percent.

Asset Quality Metrics Remained Generally Favorable, Though Weakness in Certain Portfolios Persists: Past-due and nonaccrual (PDNA) loans, or loans that are 30 or more days past due or in nonaccrual status, increased six basis points from the prior quarter to 1.54 percent of total loans. The industry’s PDNA ratio is still well below the pre-pandemic average of 1.94 percent. The PDNA ratio for non-owner occupied commercial real estate loans of 2.07 percent was at its highest level since fourth quarter 2013, driven by office portfolios at the largest banks, those with greater than $250 billion in assets. However, these banks tend to have lower concentrations of such loans in relation to total assets and capital than smaller institutions, mitigating the overall risk.

The industry’s net charge-off ratio decreased one basis point to 0.67 percent from the prior quarter but was 16 basis points higher than the year-ago quarter. This ratio was the second-highest quarterly ratio reported by the industry since second quarter 2013. The credit card net charge-off ratio was 4.48 percent in the third quarter, down 34 basis points quarter over quarter but still 100 basis points above the pre-pandemic average.

Loan Balances Increased Modestly From the Prior Quarter and a Year Ago: Total loan and lease balances increased $76.9 billion (0.6 percent) from the previous quarter. The increase was driven by higher loans to nondepository financial institutions (NDFIs) (up $28.0 billion, or 3.2 percent) and consumer loans (up $15.4 billion, or 0.7 percent). Most banks (68.2 percent) reported quarterly loan growth, and all major loan categories except construction and development loans and commercial and industrial loans showed quarter-over-quarter growth.

Total loan and lease balances increased by $275.5 billion (2.2 percent) from the prior year. The annual increase was led by loans to NDFIs (up $112.9 billion, or 14.4 percent) and credit card loans (up $62.2 billion, or 5.9 percent). A strong majority of banks (81.2 percent) reported annual loan growth.

Community banks reported a 1.1 percent increase in loan and lease balances from the previous quarter and a 5.5 percent increase from the prior year. Growth in nonfarm, nonresidential CRE loans and 1-4 family residential mortgage loans drove both the quarterly and annual increases in loan and lease balances. Loan growth was broad based across community banks, with nearly 70 percent of such banks reporting higher loan balances from the prior quarter.

Domestic Deposits Increased From Last Quarter, Driven By Higher Uninsured Deposits: Domestic deposits increased $194.6 billion (1.1 percent) from second quarter 2024. Both savings and transaction deposits increased from the prior quarter, with declines in small time deposits partially offsetting the increases. Brokered deposits decreased for the third straight quarter, down $47.2 billion (3.6 percent) from the prior quarter.

Estimated insured deposits were roughly flat this quarter (down $1.3 billion, or 0.0 percent) while estimated uninsured domestic deposits increased $197.3 billion (2.7 percent). Growth in estimated uninsured deposits was widespread; most banks (59.3 percent) reported an increase in such deposits from the prior quarter.

The Deposit Insurance Fund Reserve Ratio Increased Four Basis Points to 1.25 Percent: In the third quarter, the Deposit Insurance Fund balance increased $3.9 billion to $133.1 billion. The reserve ratio increased four basis points during the quarter to 1.25 percent.

The Total Number of Insured Institutions Declined: The total number of FDIC-insured institutions declined by 21 during the quarter to 4,517. Three banks were sold to credit unions, one bank closed, and 18 institutions merged with other banks during the quarter. One bank opened and no banks failed in the third quarter.

| 1 | The “pre-pandemic average” is the average from first quarter 2015 through fourth quarter 2019 and is used consistently throughout this press release. |