FDIC-Insured Institutions Reported Net Income of $79.8 Billion in First Quarter 2023

For Release

- Net Income Increased From the Prior Quarter, Led By Higher Noninterest Income

- The Net Interest Margin Declined Quarter Over Quarter to 3.31 Percent

- Unrealized Losses on Securities Declined For a Second Consecutive Quarter

- Loan Balances Declined Modestly From Last Quarter, But Grew From a Year Ago

- Total Deposits Declined For a Fourth Consecutive Quarter

- Asset Quality Metrics Remained Favorable Despite Modest Deterioration

- Community Banks Reported Lower Net Income From the Prior Quarter

“The banking industry has proven to be quite resilient during this period of stress. Net income still remains high in relation to historical measures, asset quality metrics remain favorable, and the industry remains well capitalized. However, the industry continues to face significant downside risks from the effects of inflation, rising market interest rates, slowing economic growth, and geopolitical uncertainty.”

— FDIC Chairman Martin J. Gruenberg

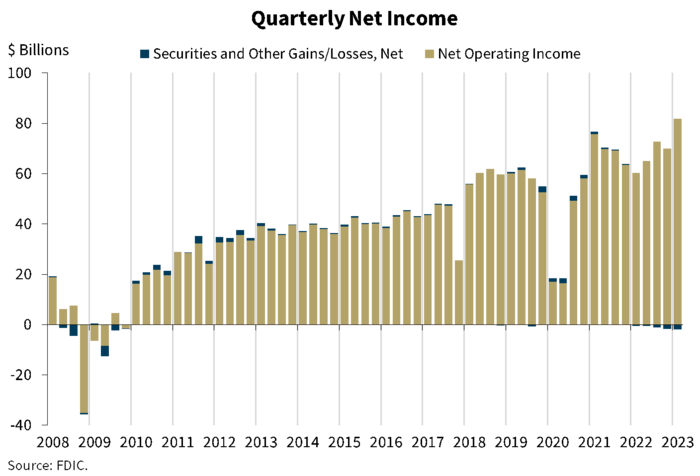

WASHINGTON— Reports from 4,672 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $79.8 billion in first quarter 2023. Though first-quarter net income increased by $11.5 billion (16.9 percent) from fourth quarter 2022, after excluding the effects on acquirers’ incomes of their acquisition of two failed banks, quarter-over-quarter net income would have been roughly flat. Strong growth in noninterest income, reflecting the accounting treatment of the acquisition of two failed institutions and record-high trading revenue at large banks, outpaced lower net interest income and higher noninterest expense. These and other financial results for first quarter 2023 are included in the FDIC’s latest Quarterly Banking Profile released today.

Highlights from the First Quarter 2023 Quarterly Banking Profile

Quarterly Net Income Increased Quarter Over Quarter and Year Over Year: Quarterly net income totaled $79.8 billion in first quarter 2023, an increase of $11.5 billion (16.9 percent) from fourth quarter 2022. Growth in noninterest income, reflecting the accounting treatment of the acquisition of two failed institutions and record-high trading revenue at large banks, outpaced lower net interest income and higher noninterest expense. Without the two failed-bank acquisitions, net income would have been roughly flat from the fourth quarter. Year-over-year net income increased $20.1 billion (33.6 percent) as growth in net interest income exceeded growth in provision expense and noninterest expense.

The banking industry reported an average return on assets (ROA) of 1.36 percent in the first quarter, up from 1.16 percent in fourth quarter 2022 and 1.01 percent in first quarter 2022.

The Net Interest Margin Declined Quarter Over Quarter to 3.31 Percent: The net interest margin (NIM) of 3.31 percent was 7 basis points lower than a quarter ago, but 77 basis points higher than the year-ago quarter. The NIM is still above the pre-pandemic average of 3.25 percent. 1

The decline in the NIM reflects the cost of deposits (i.e., the interest banks pay on deposits) rising at a faster rate than yields on loans (i.e., the interest bank charge on loans). Yields on loans increased 32 basis points from the prior quarter to 6.08 percent, while the cost of deposits increased 43 basis points from fourth quarter 2022 to 1.42 percent.

Unrealized Losses on Securities Declined For a Second Consecutive Quarter: Unrealized losses on securities totaled $515.5 billion in the first quarter, down $102.2 billion (16.5 percent) from the prior quarter. 2 Unrealized losses on held-to-maturity securities totaled $284.0 billion in the first quarter. Unrealized losses on available-for-sale securities totaled $231.6 billion in the first quarter. 3

Community Bank Net Income Declined From the Prior Quarter, but Improved From a Year Ago: Quarterly net income for the 4,230 community banks insured by the FDIC declined by $306.0 million (4.2 percent) from one quarter ago to $7.0 billion in first quarter 2023. Lower net interest income and noninterest income were higher than decreases in provision expense and noninterest expense. First quarter net income rose $403.6 billion (6.1 percent) from the year-ago quarter, driven by higher net interest income. The community bank pretax ROA declined 21 basis points from one quarter ago to 1.27 percent, but rose one basis point from a year ago.

The average community bank quarterly NIM declined 22 basis points from the prior quarter, but increased 37 basis points from the year-ago quarter to 3.49 percent. Yields on loans rose 16 basis points quarter over quarter and 94 basis points year over year, while cost of deposits rose 39 basis points quarter over quarter and 92 basis points year over year.

Loan Balances Declined Modestly From Last Quarter, But Grew From a Year Ago: Total loan and lease balances declined $14.6 billion (0.1 percent) from the previous quarter. Loans transferred to the FDIC as receiver, combined with a seasonal decline in credit card loan balances (down $26.6 billion, or 2.6 percent) were the major contributors to the quarterly decline in total loan balances for the banking industry. Without the loans transferred out of the banking system to the FDIC, loan growth would have been 0.4 percent quarter over quarter.

Year over year, total loan and lease balances increased $855.2 billion (7.5 percent), driven by growth in one-to-four family residential mortgages (up $232.1 billion, or 10.2 percent), consumer loans (up $156.4 billion, or 8.3 percent), and commercial and industrial loans (up $138.7 billion, or 5.8 percent).

Community banks reported a 1.8 percent increase in loan balances from the previous quarter and a 15.0 percent increase from the prior year. Growth in nonfarm, nonresidential commercial real estate and 1-4 family residential mortgages drove both the quarterly and annual increase in loan balances.

Asset Quality Metrics Remained Favorable Despite Modest Deterioration: Loans that were 90 days or more past due or on nonaccrual status (i.e., noncurrent loans) increased to 0.75 percent, up 2 basis points from the prior quarter. Noncurrent nonfarm, nonresidential commercial real estate loan balances drove the increase in the noncurrent rate. Total net charge-offs as a ratio of total loans increased 5 basis points from the prior quarter and 19 basis points from a year prior to 0.41 percent. The year-over-year increase was driven by the higher credit card net charge-off rate of 3.09 percent (up 124 basis points). Despite the increase, the total net charge-off rate remains below the pre-pandemic average of 0.48 percent. The early delinquency rate (i.e., loans past due 30-89 days) declined 4 basis points from the prior quarter to 0.52 percent. The total early-stage delinquency rate also was below the pre-pandemic average of 0.66 percent.

The Reserve Ratio for the Deposit Insurance Fund Declined to 1.11 Percent: The Deposit Insurance Fund (DIF) balance was $116.1 billion on March 31, 2023, down $12.1 billion from the end of fourth quarter 2022, largely reflecting provisions for actual and anticipated failures in the first quarter, including the recent failures of three institutions. When combined with insured deposit growth of 2.5 percent over the quarter, the reserve ratio decreased 14 basis points to 1.11 percent.

Merger Activity Continued in the First Quarter: Thirty-one institutions merged, one new bank opened, two banks failed, and one bank self-liquidated in first quarter 2023.

| 1 | The “pre-pandemic average” refers to the period of first quarter 2015 through fourth quarter 2019 and is used consistently throughout this press release. |

| 2 | Amended and resubmitted Call Reports changed fourth quarter 2022 value to -$617.7 billion from the -$620.4 billion reported in the fourth quarter 2022 Quarterly Banking Profile released on February 28, 2023. |

| 3 | Due to rounding, values do not add up to the aggregate value. |