FDIC-Insured Institutions Reported Net Income of $70.4 Billion in Second Quarter 2021

For Release

- Quarterly Net Income Continued to Increase Year Over Year, Driven by a Second Consecutive Quarter of Negative Provision Expense

- Net Interest Margin Contracted Further to a New Record Low

- Quarterly Loan Balances Grew For First Time Since Second Quarter 2020

- Asset Quality Continued to Improve

- Community Banks Reported an Increase in Quarterly Net Income from a Year Ago

“ With strong capital and liquidity levels to support lending and protect against potential losses, the banking industry continued to support the country’s needs for financial services while navigating the challenges presented by the pandemic.”

— FDIC Chairman Jelena McWilliams

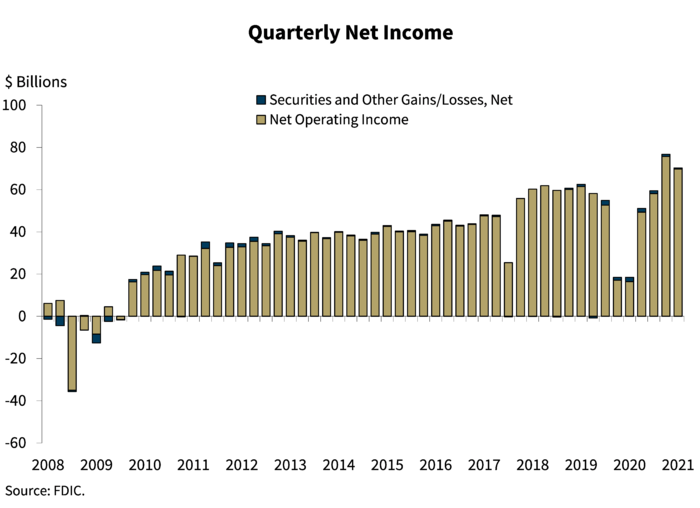

WASHINGTON — Reports from the 4,951 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $70.4 billion in second quarter 2021, an increase of $51.9 billion (281 percent) from a year ago. 1 This increase was driven by further economic growth and improved credit conditions, which led to a second consecutive quarter of aggregate negative provision expense. These and other financial results for second quarter 2021 are included in the FDIC’s latest Quarterly Banking Profile released today.

“The banking industry reported strong earnings in second quarter 2021, supported by continued economic growth and further improvements in credit quality,” McWilliams said.

Highlights from the Second Quarter 2021 Quarterly Banking Profile

Quarterly Net Income Continued to Increase Year Over Year, Driven by a Second Consecutive Quarter of Negative Provision Expense: Net income totaled $70.4 billion, an increase of $51.9 billion (281 percent) from the same quarter a year ago, primarily due to a $73 billion (117.3 percent) decline in provision expense. Nearly two-thirds of all banks (66.4 percent) reported annual improvements in quarterly net income, and the share of profitable institutions increased slightly, up 1.4 percent year over year to 95.8 percent. However, net income declined $6.4 billion (8.3 percent) from first quarter 2021, driven by an increase in provision expense from first quarter 2021 (up $3.7 billion to negative $10.8 billion).

The banking industry reported an aggregate return on average assets ratio of 1.24 percent, up 89 basis points from a year ago but down 14 basis points from first quarter 2021.

Net Interest Margin Continued to Contract to a New Record Low: The average net interest margin (NIM) contracted 31 basis points from a year ago to 2.50 percent—the lowest level on record. NIM contraction was accompanied by a decline in net interest income of $2.2 billion (1.7 percent) from the same quarter a year ago.

The year-over-year reduction in earning asset yields continued to outpace the decline in average funding costs, both of which declined further from first quarter 2021 to record lows. Reductions in net interest income at the largest institutions drove the aggregate decline in net interest income, as more than three-fifths of all banks (64.1 percent) reported higher net interest income compared with a year ago.

Community Banks Reported a 28.7 Percent Increase in Quarterly Net Income Year Over Year: Community banks reported annual net income growth of $1.9 billion, supported by a decline in provision expense and an increase in net interest income. Provision expenses declined $2.3 billion (98.1 percent) from a year ago and $345.1 million (88.2 percent) from the previous quarter. Higher commercial and industrial (C&I) loan income, reflecting, in part, increased fee income from the payoff and forgiveness of Paycheck Protection Program (PPP) loans, helped lift net interest income $1.4 billion (7.2 percent) from the same quarter a year ago.

More than half (53.1 percent) of the 4,490 FDIC-insured community banks reported higher quarterly net income. However, the net interest margin for community banks narrowed further, with a decline of 26 basis points to 3.25 percent, as the continued reduction in average earning asset yields outpaced the decline in average funding costs.

Loan Volume Grew Slightly from First Quarter 2021, Driven by an Increase in Credit Card Balances: Total loan and lease balances increased $33.2 billion (0.3 percent) from the previous quarter. This was the first quarterly increase in loan volume since second quarter 2020. An increase in credit card loan balances (up $30.9 billion, or 4.1 percent), supplemented by an increase in auto loan balances (up $18.9 billion, or 3.8 percent), drove the growth.

Loan volume contracted slightly compared with the same quarter a year ago. A reduction in C&I loans (down 13.4 percent) drove an annual decline of $133.9 billion (1.2 percent) in loan volume.

Community banks reported a 0.5 percent decline in loan balances from the previous quarter, led by a decrease in C&I loan balances resulting from payoffs and forgiveness of PPP loans. Annually, community banks reported a slight increase of 0.3 percent in total loans and leases.

Credit Quality Continued to Improve: Loans that were 90 days or more past due or in nonaccrual status (i.e., noncurrent loans) continued to decline (down $13.2 billion, or 10.8 percent) from first quarter 2021. The noncurrent rate for total loans declined 12 basis points from the previous quarter to 1.01 percent. Net charge-offs also continued to decline (down $8.3 billion, or 53.2 percent) from a year ago. The total net charge-off rate dropped 30 basis points to 0.27 percent—the lowest level on record.

The Reserve Ratio for the Deposit Insurance Fund Increased Slightly to 1.27 Percent: The Deposit Insurance Fund (DIF) balance was $120.5 billion as of June 30, up $1.2 billion from the end of the first quarter. The reserve ratio increased 2 basis points to 1.27 percent, due to continued growth in the fund balance and a 0.2 percent decline in insured deposits.

Three New Banks Opened During the Quarter: Three new banks opened, 28 institutions merged with other FDIC-insured institutions, and no banks failed in second quarter 2021.

| 1 | The number of FDIC insured institutions excludes two institutions that did not file Call Reports this quarter but continue to have active charters. |