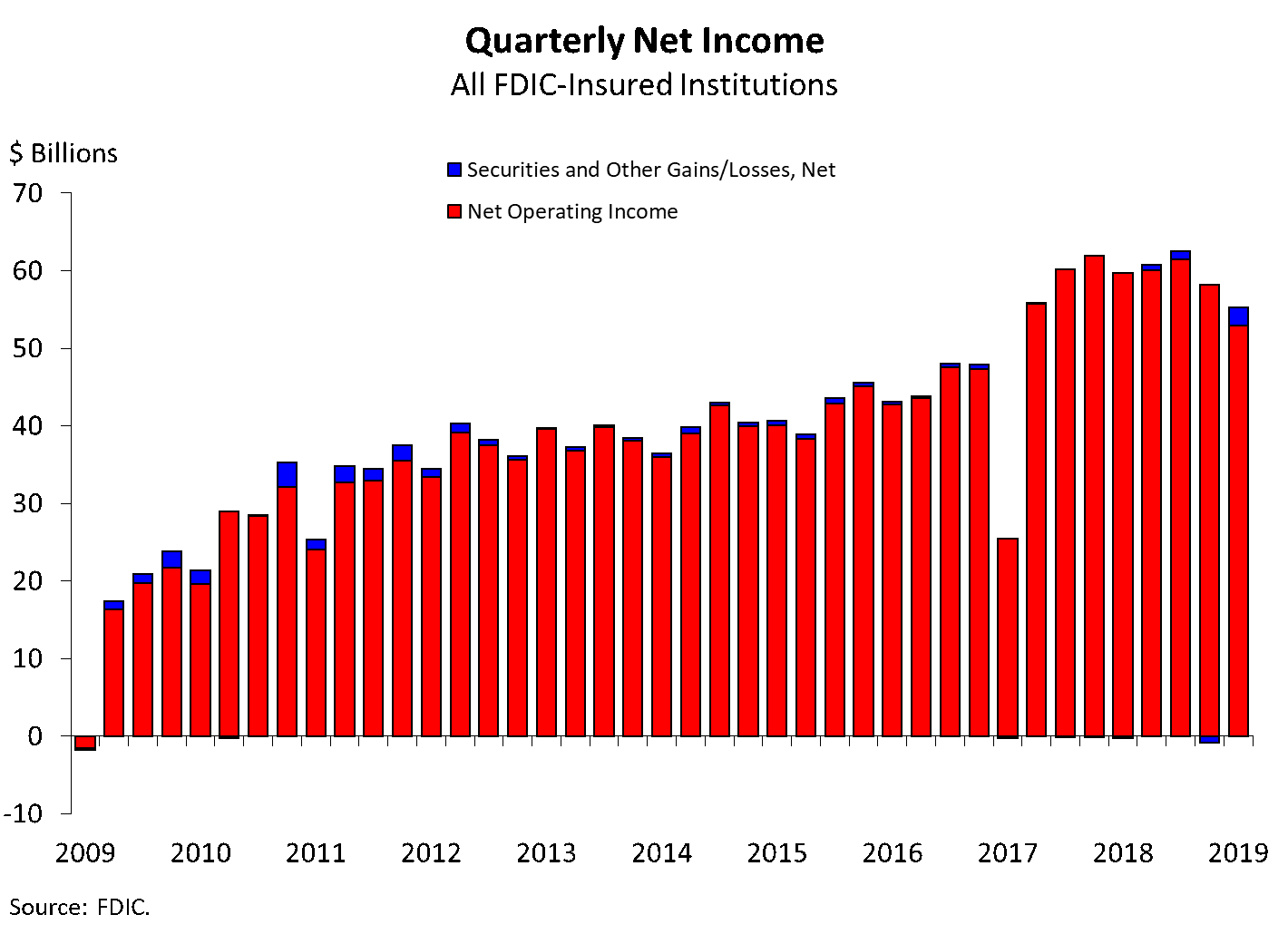

FDIC-Insured Institutions Reported Net Income of $55.2 Billion in Fourth Quarter 2019

FOR IMMEDIATE RELEASE

- Full–Year 2019 Net Income Declined 1.5 Percent to $233.1 Billion

- Quarterly Net Income Declined 6.9 Percent from Fourth Quarter 2018

- Net Interest Margin Declined from a Year Ago to 3.28 Percent

- Community Banks' Quarterly Net Income Improved 4.4 Percent from a Year Ago

- Total Loan and Lease Balances Grew from the Previous Quarter and a Year Ago

- The Number of Banks on the "Problem Bank List" Remained Low

"The banking industry reported strong results, despite declines in full–year and quarterly net income. In the current economic environment, the FDIC encourages banks to maintain careful underwriting standards and prudent risk management."

—

FDIC Chairman Jelena McWilliams

For the 5,177 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC), aggregate net income totaled $55.2 billion in fourth quarter 2019, a decline of $4.1 billion (6.9 percent) from a year ago. The decline in net income was led by lower net interest income and higher expenses. Financial results for fourth quarter 2019 are included in the FDIC's latest Quarterly Banking Profile released today.

"The banking industry remains strong, despite declines in full-year and quarterly net income," McWilliams said. "Loan balances continue to rise, asset quality indicators are stable, and the number of 'problem banks' remains low. Community banks reported another positive quarter. Net income at community banks improved because of higher net operating revenue, and the annual loan growth rate at community banks exceeded the overall industry."

"During the second half of 2019, we saw three reductions in short-term interest rates and yield-curve inversions. These factors present challenges for banks' credit extension and funding. It is vital that banks maintain careful underwriting standards and prudent risk management in order to maintain lending through economic fluctuations."

Highlights from the Fourth Quarter 2019 Quarterly Banking Profile

Full-Year 2019 Net Income Declined 1.5 Percent to $233.1 Billion: The banking industry reported full-year 2019 net income of $233.1 billion, down $3.6 billion (1.5 percent) from 2018. The decline in net income was primarily due to slower growth in net interest income and higher loan-loss provisions. Lower noninterest income also contributed to the trend. The average return on assets declined from 1.35 percent in 2018 to 1.29 percent in 2019.

Quarterly Net Income Declined 6.9 Percent from Fourth Quarter 2018: The 5,177 FDIC-insured institutions reported aggregate net income of $55.2 billion in fourth quarter 2019, a decline of $4.1 billion (6.9 percent) from a year earlier. The quarterly decline in net income was led by lower net interest income coupled with higher noninterest expenses. The decline was broad-based, as nearly half (45.6 percent) of all institutions reported annual declines in net income. The share of unprofitable institutions remained stable from a year ago at 7.2 percent. The average return on assets ratio declined from 1.33 percent in fourth quarter 2018 to 1.20 percent in fourth quarter 2019.

Net Interest Margin Declined from a Year Ago to 3.28 Percent: The average net interest margin declined by 20 basis points from a year ago to 3.28 percent. Net interest income fell by $3.4 billion (2.4 percent) from a year ago. This was the first annual decline since third quarter 2013. Lower yields on earning assets drove the reduction in net interest income.

Community Banks' Quarterly Net Income Improved 4.4 Percent from a Year Ago: The 4,750 FDIC-insured community banks reported quarterly net income of $6.4 billion, up $270.3 million from a year ago. More than half of all community banks (53.9 percent) reported net income growth. Net interest income increased by 2.1 percent because of strong annual loan growth (up 5.5 percent). The average community bank net interest margin fell by 15 basis points to 3.62 percent.

Total Loan and Lease Balances Grew from the Previous Quarter and a Year Ago: Total loan and lease balances increased by $117.9 billion (1.1 percent) from the previous quarter. Growth among major loan categories was led by consumer loans, which includes credit cards (up $58.2 billion, or 3.3 percent) and residential mortgage loans (up $19 billion, or 0.9 percent). The commercial and industrial loan portfolio reported the first quarterly decline (down $11.0 billion, or 0.5 percent) since fourth quarter 2016. Over the past year, total loan and lease balances increased by 3.6 percent, slightly below the annual growth rate reported in third quarter 2019.

The Number of Banks on the "Problem Bank List" Remained Low: The number of problem banks fell from 55 to 51 during the fourth quarter, the lowest number of problem banks since fourth quarter 2006. Total assets of problem banks declined from $48.8 billion in the third quarter to $46.2 billion.

Asset Quality Indicators Remained Stable: The average noncurrent loan rate remained relatively stable from the previous quarter. Noncurrent balances declined for all major loan categories, except for credit card loans, which increased by $1.3 billion (10.3 percent). Net charge-offs rose by $1.3 billion (10.4 percent) from a year ago, and the average net charge-off rate rose by 4 basis points to 0.54 percent. Asset quality metrics for community banks remained relatively steady; the noncurrent rate fell by 3 basis points to 0.75 percent, and the net charge-off rate rose by 3 basis points to 0.18 percent.

The Deposit Insurance Fund's Reserve Ratio Stood at 1.41 Percent: The Deposit Insurance Fund (DIF) balance totaled $110.3 billion in the fourth quarter, up $1.4 billion from the end of last quarter. The quarterly increase was led by assessment income and interest earned on investment securities held by the DIF. The reserve ratio remained unchanged from the previous quarter at 1.41 percent.

Mergers and New Bank Openings Continued in the Fourth Quarter: During the fourth quarter, three new banks opened, 77 institutions were absorbed by mergers, and three banks failed.