FDIC-Insured Institutions Report Net Income of $59.1 Billion in Fourth Quarter 2018

FOR IMMEDIATE RELEASE

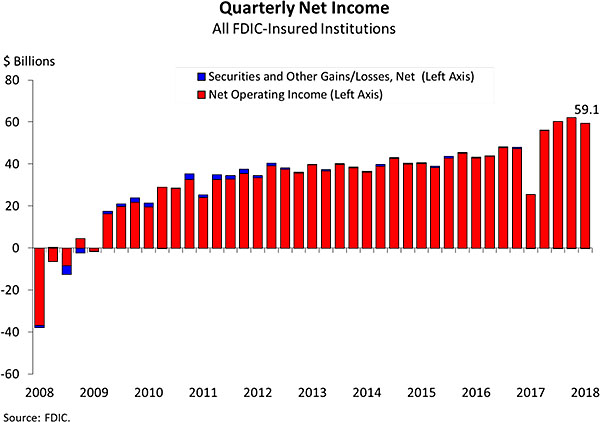

- Net Income Rises $33.8 Billion Over Fourth Quarter 2017

- Higher Net Operating Revenue and Lower Income Tax Expenses Lift Net Income

- Community Banks Net Income Increases $2.7 Billion from a Year Earlier

- Net Interest Income Increases 8.1 Percent from a Year Earlier

- Total Loan and Lease Balances Rise 4.4 Percent Over 12 Months

- Full-Year 2018 Net Income Grows to $236.7 Billion

- Number of “Problem Banks” Drops to 60

"The banking industry continued to report strong results, and the FDIC is actively monitoring economic conditions to ensure banks remain resilient." — FDIC Chairman Jelena McWilliams

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $59.1 billion in the fourth quarter of 2018, up $33.8 billion (133.4 percent) from a year ago. The improvement in net income was led by higher net operating revenue and lower income tax expenses. Financial results for the fourth quarter of 2018 are included in the FDIC’s latest Quarterly Banking Profile released today.

"The banking industry continued to report strong results," McWilliams said. "Growth in net income was attributable to higher net operating revenue and a lower effective tax rate. Loan balances expanded, net interest margins improved, and the number of ‘problem banks’ continued to decline. Community banks also had a strong quarter, with annual loan growth and a net interest margin that exceeded the overall industry."

"Low interest rates and an increasingly competitive lending environment have led some institutions to reach for yield, and the recent flattening of the yield curve may present new challenges in lending and funding. Therefore, banks must maintain prudent management of these risks in order to support lending through this economic cycle."

Highlights from the Fourth Quarter 2018 Quarterly Banking Profile

Quarterly Net Income Rises $33.8 Billion Over Fourth Quarter 2017: In the fourth quarter of 2018, 5,406 insured institutions reported quarterly net income of $59.1 billion, up $33.8 billion (133.4 percent) from a year ago. Lower income tax expenses, coupled with higher net operating revenue boosted quarterly net income. After adjusting fourth quarters 2017 and 2018 to reflect the average effective tax rate prior to the 2017 tax law, quarterly net income would have been $50.3 billion in fourth quarter 2018, an increase of 18.5 percent from a year ago.

Full-Year 2018 Net Income Increases to $236.7 Billion: The banking industry reported full-year 2018 net income of $236.7 billion, up $72.4 billion (44.1 percent) from 2017. Adjusted for tax reform effects in the same manner as for quarterly net income, full-year 2018 would have been $207.9 billion, an increase of 13.6 percent from 2017.

Community Banks Net Income Increases $2.7 Billion from a Year Earlier: The 4,979 insured institutions identified as community banks reported net income of $6.8 billion in the fourth quarter, up $2.7 billion (65.1 percent) from a year ago. Excluding the benefits of a lower effective tax rate, estimated fourth quarter net income would have increased by 11.2 percent from a year ago. Net operating revenue was up $1.4 billion to $24.3 billion, due to increases in both net interest income and noninterest income. Loan-loss provisions declined 10.4 percent, and noninterest expenses increased 3.6 percent compared with a year earlier.

Net Interest Income Increases 8.1 Percent from Fourth Quarter 2017: Net interest income totaled $140.2 billion in the fourth quarter, a $10.5 billion (8.1 percent) increase from a year ago. More than four out of five banks (82.6 percent) reported an improvement in net interest income from a year ago. The average net interest margin was 3.48 percent in the fourth quarter, up from 3.31 percent a year ago.

Total Loan and Lease Balances Rise 4.4 Percent Over 12 Months: Total loan and lease balances increased 2.1 percent from third quarter 2018, reflecting fourth-quarter growth in all major loan categories. Commercial and industrial loans grew by $80.7 billion (3.9 percent) from the third quarter, and credit card balances, reflecting a seasonal increase in balances, rose by $47.2 billion (5.5 percent). Over the past 12 months, total loan and lease balances increased by 4.4 percent, a slight increase from the 4 percent annual growth rate reported in the third quarter of 2018. Commercial and industrial loans registered the largest dollar increase from a year ago (up $156.2 billion, or 7.8 percent).

Noncurrent Loan Rate and Net Charge-Off Rate Decline: The amount of loans that were noncurrent – 90 days or more past due or in nonaccrual status – decreased by $1 billion (1 percent) during the fourth quarter. Noncurrent balances for residential mortgages were down $2 billion (4.4 percent) and commercial and industrial loans were down $554.3 million (3.6 percent), but noncurrent balances for credit cards were up $1.6 billion (13.8 percent). The average noncurrent loan rate declined 3 basis points from the third quarter to 0.99 percent. Net charge-offs declined by $605.9 million (4.6 percent) from a year ago, as the average net charge-off rate fell from 0.55 percent to 0.50 percent.

The Number of Banks on the “Problem Bank List” Declines to 60: The FDIC’s Problem Bank List declined from 71 to 60 during the fourth quarter, the lowest number of problem banks since first quarter 2007. Total assets of problem banks declined from $53.3 billion in the third quarter to $48.5 billion. During the fourth quarter, merger transactions absorbed 70 institutions, two new charters were added, and no failures occurred.

The Deposit Insurance Fund’s Reserve Ratio Remained at 1.36 Percent: The Deposit Insurance Fund (DIF) balance rose by $2.4 billion from the end of the third quarter to $102.6 billion. The increase was mainly driven by assessment income, unrealized gains, and interest income on securities held by the DIF. The DIF reserve ratio remained unchanged from the third quarter at 1.36 percent as insured deposits also rose.

Congress created the Federal Deposit Insurance Corporation in 1933 to restore public confidence in the nation’s banking system. The FDIC insures deposits at the nation’s banks and savings associations, 5,406 as of December 31, 2018. It promotes the safety and soundness of these institutions by identifying, monitoring and addressing risks to which they are exposed. The FDIC receives no federal tax dollars—insured financial institutions fund its operations.

FDIC press releases and other information are available on the Internet at www.fdic.gov, by subscription electronically (go to www.fdic.gov/about/subscriptions/index.html) and may also be obtained through the FDIC’s Public Information Center (877-275-3342 or 703-562-2200).