The Consumer Response Unit of the FDIC National Center for Consumer and Depositor Assistance investigates consumer complaints involving FDIC-supervised banks, analyzes complaint data to identify trends and emerging issues, serves as a resource for examination staff, and educates consumers about consumer protection laws. The following information provides an overview of the FDIC’s consumer complaint process and describes information needed for the Consumer Response Unit to properly review and respond.

Frequently Asked Questions

Use any of the links below to view responses to frequently asked questions received by the Consumer Response Unit prior to submitting a complaint. The responses provide essential information related to complaints against FDIC-supervised banks and other topics related to consumer support.

Complaint/ Inquiry Process

- What information do I need to submit a banking-related complaint to the FDIC Consumer Response Unit? >

- What happens when I submit a web form through the FDIC Information and Support Center? >

- What happens if I submit mail or a referral from another agency? >

- What happens when my correspondence is referred to the FDIC from another agency? >

- What will the Consumer Response Unit do once it receives my complaint? >

- How do I contact the Consumer Response Unit? >

How do I identify and contact my Bank's regulator?

Look at your bank statements, the back of your bank cards, or the bank’s website to identify the full name of your bank and where it is located.

You can find out which agency regulates your bank on BankFind. There are four different federal banking regulators. While the FDIC may insure the funds at your bank, the FDIC may not be your bank’s federal regulator. It’s important you contact the correct regulator.

- Federal Deposit Insurance Corporation (FDIC): https://ask.fdic.gov/fdicinformationandsupportcenter

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/about-us/contact-us/

- Office of the Comptroller of the Currency (OCC): https://www.occ.treas.gov/about/connect-with-us/contact-the-occ/index-contact-the-occ.html

- Federal Reserve (FED): https://www.federalreserveconsumerhelp.gov/

Who Regulates Credit Unions?

Credit Unions are insured by the National Credit Union Administration (NCUA) and regulated by the NCUA or the state.

NCUA Consumer Assistance Center

How do I identify and contact my Credit Union's regulator?

Look at your credit union’s statements or the credit union’s website to identify the full name of the credit union and where it is located.

You can find out who regulates your credit union at https://mapping.ncua.gov/ResearchCreditUnion

Contact the National Credit Union Administration (NCUA) Consumer Assistance Center

What are Subsidiaries and Trade Names?

Banks may operate under the name of a subsidiary or trade name that may not be an FDIC insured institution.

Subsidiaries are businesses that are wholly-owned or partly-owned by another business, such as a bank.

Trade Names are advertised names of a business or bank that may differ from its registered name.

You may need to review your account statements, disclosures, or the business’ website to determine if it has a different registered name or is the subsidiary of a bank. You can also search website URLs on BankFind instead of the bank name to identify the bank involved.

Your concerns may involve a financial services company that is not a bank, such as a non-bank mortgage company, private student lender, payday lender, or a debt collector. In these instances, you may wish to contact the Consumer Financial Protection Bureau (CFPB) or your respective state’s consumer protection office. You can review the CFPB’s website for information on institutions subject to CFPB supervisory authority and instructions for filing a complaint.

You can review CFPB’s supervisory authority and oversight at: https://www.consumerfinance.gov/compliance/supervision-examinations/institutions/ or https://www.consumerfinance.gov/complaint/

What information do I need to submit a banking-related complaint to the FDIC Consumer Response Unit?

To ensure the Consumer Response Unit has adequate information to understand your issue, share with the applicable FDIC-supervised institutions for response, and promptly respond to you, we require for the following:

- Your first and last name

- Your email address and mailing address

- Complete name and address of the applicable financial institution(s) involved. It’s important you verify this information because your bank may share the same or similar name as others. You may verify your bank using FDIC’s BankFind Suite: Find Institutions by Name & Location.

- A detailed description of the issue(s) in writing in the order in which they occurred up front, including any names, phone numbers, and dates and amounts of any transactions involved.

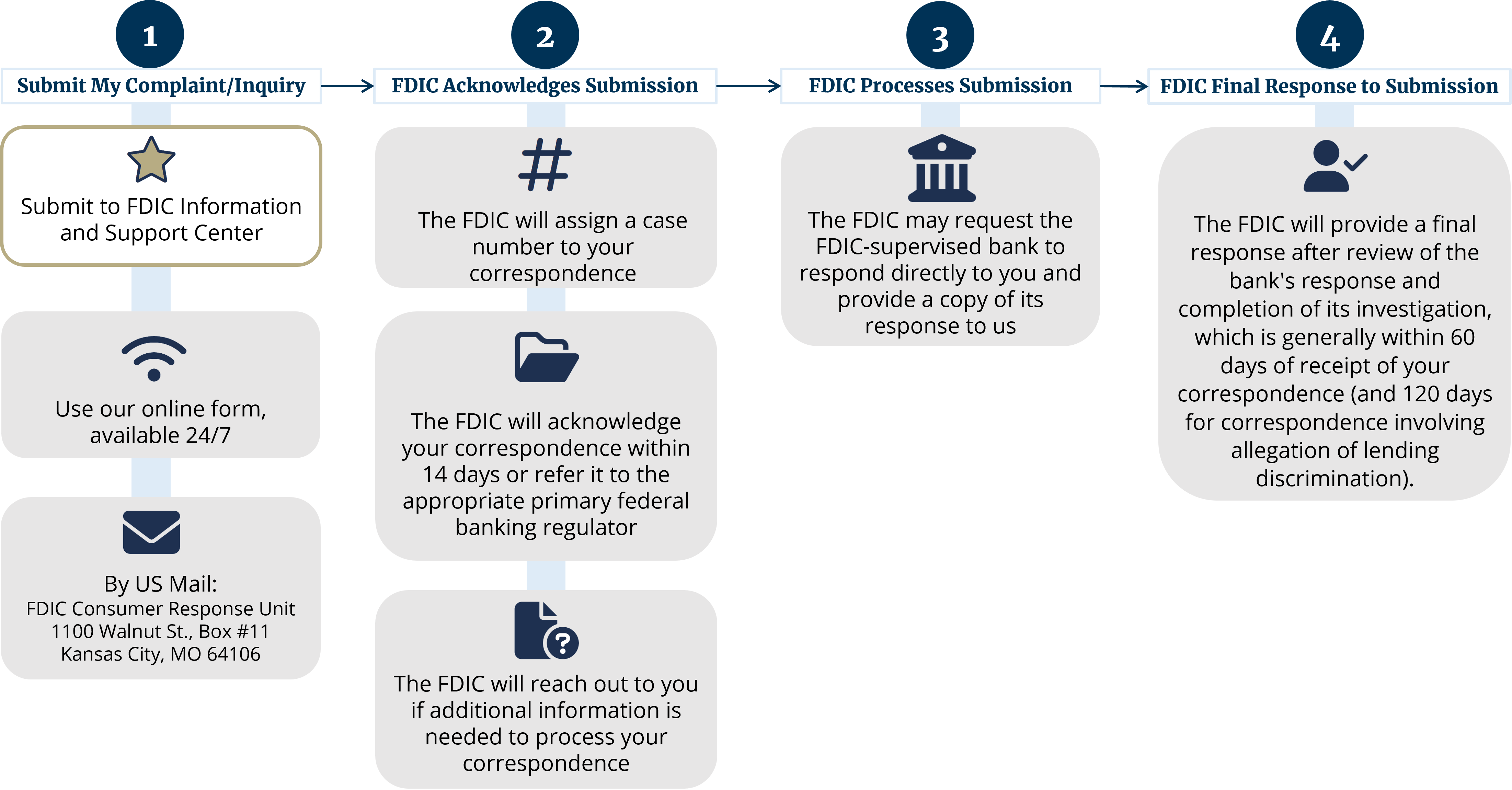

What happens when I submit a web form through the FDIC Information and Support Center?

If you log in as a registered user, you will be able to upload supporting documentation. Additionally, the FDIC will be able to upload the final response to your correspondence.

The FDIC Consumer Response Unit will review your correspondence to determine how it should be processed. If your correspondence is regarding a FDIC supervised institution, we will contact the bank and respond to you.

- If the involved bank is an FDIC supervised institution

- If the noted concerns fall outside the FDIC’s enforcement jurisdiction

- If additional correspondence is needed regarding your concerns

What happens if I submit mail or a referral from another agency?

The CRU will acknowledge receipt of your complaint within 14 days, if a response cannot be provided within that period.

The CRU will review your complaint to determine whether:

- The FDIC is the primary federal regulator for the institutions involved;

- The presented issue(s) fall within FDIC’s jurisdiction to act on; and whether

- Additional information may be needed from you to process your correspondence

What happens when my correspondence is referred to the FDIC from another agency?

The CRU will acknowledge receipt or respond to your complaint within 14 days.

The CRU will review your complaint to determine:

- If the involved bank is an FDIC supervised institution

- If the noted concerns fall outside the FDIC’s enforcement jurisdiction

- If additional correspondence is needed regarding your concerns

What will the Consumer Response Unit do once it receives my complaint?

A FDIC representative will review the complaint and take one of three actions:

- Direct Response. We will respond directly to your concerns if the request does not involve a bank, requires additional information or clarity, falls outside of the jurisdiction of the FDIC, or has previously been reviewed. We may also respond directly to you without contacting a bank on your behalf. The CRU will generally respond to your complaint within 14 days.

- Refer. If your concerns involve a bank outside of the FDIC’s direct supervisory oversight, we will refer your correspondence to the appropriate regulatory agency. The CRU will generally respond to your complaint within 14 days.

- Contact the Bank. We will send the correspondence to the named bank for review and response. The CRU will generally respond to your complaint within 60 days.

How do I contact the Consumer Response Unit?

Complaints or inquiries against a bank must be submitted in writing.

Online:

- By completing a web form at https://ask.fdic.gov

In Writing:

- 1100 Walnut Street

Box #11

Kansas City, MO 64106

By telephone for General Inquiries Only:

- At 877-275-3342 Monday through Friday from 7:00 am to 5:00 pm CT. On Saturday from 7:00 am to 12:00 pm CT. Excluding Holidays.

What are the top tips for avoiding scams?

DO NOT:

- Share numbers or passwords for accounts, credit cards, or Social Security

- Pay up front for a promised prize

- Click on links or scan QR codes from an unknown source

- Send cash, gift cards, or money transfers to an unknown recipient

DO:

- Beware if someone claims to be from the government, a bank, a business, or a family member, and is asking you to pay money

- Be careful with unfamiliar links and new website addresses

- Resist the pressure to act immediately

- Sign up for Scam Alerts on the Federal Trade Commission’s (FTC) website.

What are Common Types of Scams and Frauds?

- Imposters

- Voice cloning

- Online shopping

- Prizes, sweepstakes, lotteries

- Tech support

- Business and job opportunities

- Wire transfer

- Check washing

- Fake check

- Romance

- Elder financial exploitation

What do you do if you are a scam victim?

Report the incident to the Federal Trade commission (FTC) at https://reportfraud.ftc.gov. The FTC uses reported information to build cases against scammers, spot trends, educate, and share data. The FTC enters Internet, telemarketing, identity theft and other fraud-related complaints into Consumer Sentinel, a secure, online database available to hundreds of civil and criminal law enforcement agencies in the U.S. and abroad.

If you received any correspondence via the Internet, you should report the incident to the Internet Crime Complaint Center (ICCC) at www.ic3.gov. The ICCC is a central repository for complaints related to Internet fraud, developed by the Federal Bureau of Investigation and the National White Collar Crime Center. Complaints filed via this website may be referred to law enforcement/regulatory agencies for possible investigation.